The twelve project developers with the largest pipelines all share one thing in common: access to a large balance sheet

But most of these projects will never be built. They'll run across siting, permitting, and interconnection hurdles. They'll have trouble signing PPAs at sufficient prices. Or they'll overcome the prior constraints and still be unable to close financing.

At GTM Research, we maintain a database of utility-scale PV projects in the U.S. We try to include only projects that have a reasonable chance of success given their current stage of development and their developer's track record. This whittles the total pipeline down to a more manageable 2.8 GW of projects that are likely to start generating power at some time in the next four years.

92 percent of this pipeline lies in the hands of the top twelve developers, indicating how consolidated the market remains today. Furthermore, a closer look at these twelve developers reveals that they all share a single characteristic: access to a large balance sheet. This enables them to contribute their own equity to projects, which in turn loosens the purse strings of lenders and tax equity providers.

So in an attempt to make sense of the fractured utility-scale PV market in the U.S., here is a breakdown of the top twelve project developers according to their source of balance sheet strength.

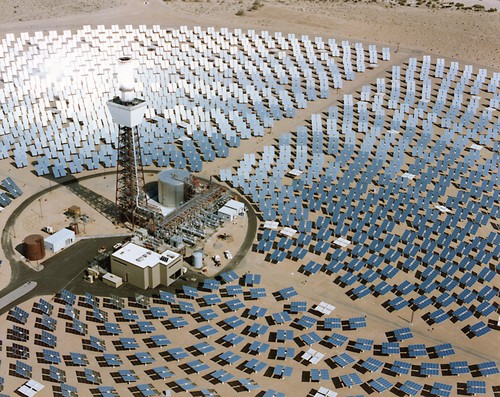

Source: GTM Research

Vertically Integrated Manufacturers

First Solar, Sunpower and BP Solar USA all have strong internal balance sheets through their own PV manufacturing operations (BP obviously also has a much larger balance sheet through its fossil fuel activities).

First Solar has, by far, the largest project pipeline, with three multi-hundred megawatt projects contracted through PPAs with California utilities (Sunlight, Stateline and Topaz) and three smaller utility-scale projects. First Solar's strategy is to build projects and then sell them prior to, or immediately upon, commencing operation. Most recently, First Solar sold its 21 MW Blythe project to NRG in November 2009. At least one of the larger projects may run across insurmountable hurdles in development. But given its track record and access to capital, First Solar gets the benefit of the doubt here.

Sunpower entered the project development game in 2006 with its acquisition of Powerlight, and has since used its downstream arm as a mechanism to create additional demand for its own modules. In contrast to First Solar, Sunpower is willing to own and operate projects, as well as developing them. Sunpower was one of the lucky few developers to raise a large project fund in 2009, with $100 million in tax equity coming from Wells Fargo in June. Its largest project in development is the 250 MW California Valley Solar Ranch, which is expected to be completed in 2012.

Gemini Solar, which is a joint venture between Fotowatio Renewable Ventures and Suntech Power, could fit in a number of these categories depending on how you classify it; I'll place it here because of the Suntech connection. Gemini's first project, a 30 MW system built through a PPA with Austin Energy, is expected to come online this year.

BP Solar USA makes the list because of a single project: the 37 MW system to be constructed at Brookhaven National Labs through a PPA with the Long Island Power Authority in New York.

Private Equity-Backed Developers

NextLight Renewable Power LLC was founded by Energy Capital Partners, a private-equity firm with over $3 billion in funds under management. Although its projects have yet to generate any power, Nextlight's huge pipeline and management team (which has deep roots in the energy project development business) have placed it as an early leader in large-scale project development. Nextlight owns another of the largest projects in our database, the 230 MW AV Solar Ranch One project, which has a PPA from PG&E. It is expected to be completed in 2013.

Recurrent Energy vaulted into the top twelve just this week with its announcement of 50 MW of PPAs from Southern California Edison. The PPAs are comprised of three utility-scale DG projects that are expected to be completed in early 2013. Recurrent raised $75 million in corporate equity in July 2008 from Hudson Clean Energy Partners, a private equity firm with over $1 billion in management. This enabled Recurrent to purchase a 350 MW pipeline from UPC Solar in March 2009, a bold gambit in the midst of an economic crisis.

Developers Owned by Larger European Renewable Energy Developers:

Fotowatio Renewable Ventures and GA-Solar both benefit from ownership by larger renewable energy project developers, both in terms of balance sheet strength and project development experience.

Renewable Ventures was purchased from MuniMae in 2008 by Fotowatio, one of Europe's largest renewable energy companies, and the company has been among the most successful at raising project finance during the credit crisis. Its most recent fund, the $200 million Solar Fund V, was raised in August 2009 with its own equity capital (likely supported by Fotowatio), as well as equity investment from Wells Fargo and debt from John Hancock Financial.

GA-Solar is a newcomer to this list, having just announced a 300 MW project in New Mexico last week. This may be the shakiest project included on our list, since no PPA appears to have been signed yet. But GA-Solar has both the project development experience (over 200 MW commissioned worldwide) and the capital backing (its parent company, Corporación Gestamp, is a $5 billion Spanish corporation) to bring the project to fruition.

Developers with Other Corporate Parents

These four don't fit into any of the other categories, but they still have access to a large balance sheet through ownership by larger corporate parents. And in each case, the corporate parents have some attachment either to the PV industry or energy project development.

Sempra Generation and PSEG Solar Source are both owned by larger energy corporations that also have utilities within their portfolios (San Diego Gas & Electric and Public Service Electric & Gas, respectively). Sempra's inclusion comes from a 48 MW expansion of its existing 10 MW El Dorado project in Nevada. Sempra has also planned a much larger, 400 MW project called Mesquite Solar that is still in the permitting process. Sempra Generation's parent, Sempra Energy, produced $11 billion in revenue in 2008. PSEG Solar Source is developing projects for AEP in Ohio and Jacksonville Electric Authority in Texas, both of which are expected to be completed this year with a combined capacity of 27 MW. PSEG, the parent company, does around $13 billion in annual revenue.

Chevron Energy Solutions, a division of the oil major Chevron Corporation, develops both solar and biomass projects. CES is developing a 45 MW project in Lucerne Valley, CA through a PPA with Southern California Edison. The project will be constructed in two stages, beginning this year with expected completion in 2012.

SunEdison would have been the anomaly on this list if it hadn't been purchased by MEMC in October 2009. But as it stands, SunEdison will benefit from MEMC's roughly $2 billion balance sheet. Expect its pipeline holdings to jump upward significantly in 2010.