SolarReserve is one of the few next-generation solar-thermal vendors with field experience.

The company has the exclusive rights to the molten-salt technology United Technologies’ Pratt &Whitney RocketDyne tested at Solar Two in the California desert during the 1990s.

“We consider that to be a strong competitive advantage,” says Tom Georgis, vice president of development.

It also is a critical reason why the Santa Monica company believes its plants will match or top the efficiency of BrightSource’s Ivanpah. And the experience is at the foundation of SolarReserve’s belief it will find financing, despite the reluctance of private lenders.

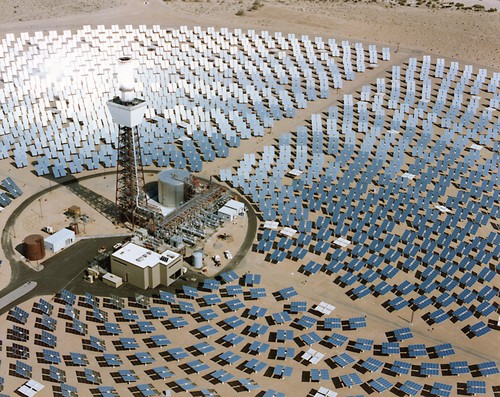

SolarReserve is among the most promising of a new wave of solar-thermal developers. Instead of replying on parabolic mirrors, like the SEGS operating in the Southwest desert, these entrepreneurs hope to prove technologies just now moving from the drawing board to large scale deployment: ground-mounted heliostats, heat-concentrating towers, high operating temperatures and storage mechanisms, such as molten salt.

The company’s proposed plants (two in the United States and one in Spain) use as many as 17,000 heliostats to reflect sunlight to receivers atop of 653-foot towers. There the sunlight transfers heat to molten salt, warming the sodium and potassium mixture to 1,050 degrees Fahrenheit, after which it is transferred to a storage tank where it loses no more than 1 degree a day. (BrightSource also anticipates more than 1,000-degree temperatures at Ivanpah.) The superheated liquid is channeled to a heat exchanger where it boils water and powers a turbine.

Solar Reserves claims high efficiencies for much of its operations. The transfer of sunlight to heated salt is 88 percent efficient and the storage tank maintains 98 to 99 percent of the thermal efficient of the molten salt. The weak link is the steam generation system: about 39 to 42 percent efficient. Improvements in turbine technology should raise this.

Altogether, a SolarReserve plant will have an efficiency of 18 to 19 percent, says Georgis. This compares favorably to the 18 percent efficiency BrightSource expects at Ivanpah. (The new generation of solar-thermal plant with concentrating towers and heliostats in general should achieve efficiencies of 17 percent to 20 percent, says Electric Power Research Institute Project Manager Cara Libby – well above the 13 to 15 percent of the older trough plants in the Southwest and Spain.)

SolarReserve also expects to rival BrightSource with its capacity factor, a measure of the amount of time a plant can achieve full output.

The California plant, outfitted with a 150-megawatt turbine, is designed to generate peak-period power for PG&E. Running an average of 8.5 hours a day, it should achieve a capacity factor of 34 percent by heating and storing salt in the mornings and using it to deliver power well into the evening.

BrightSource’s 392 megawatt Ivanpah is to have a capacity factor of 30 percent.

SolarReserve’s Nevada plant should do better. It will have a smaller 100-megawatt turbine and operate longer hours, earning a capacity factor of 53 percent. (The longer the operating hours and the smaller the turbine, the higher the capacity factor is likely to go.)

Despite the ability of the SolarReserve facilities to storage energy, the challenge will be finding financing. Without federal loan guarantees, most plants won’t stand a chance. But the company doesn’t appear ready to buy into the theory.

“It is certainly a challenging environment,” agrees Georgis. “But we are confident we will secure financing for our projects.”

SolarReserve has applied for Department of Energy loan guarantees and is quick to defend their role. “Having the DOE loan guarantees makes it easier to finance,” he says. The extensive government due diligence makes private lenders more comfortable and debt cheaper.

That’s why the industry let out a sigh of relief when Abengoa’s Solana plant near Phoenix won $1.45 billion of Energy Department loan guarantees in July – the first granted since BrightSource’s $1.37 billion package in February.

But SolarReserve appears willing to push ahead even without a government award. It hopes to break ground in both California and Nevada by the end of the year.

The company argues that utilities wouldn’t sign power purchase agreements if they didn’t value the power – a key proof-point with banks. It also largely dismisses increasing competition from solar panels.

Panels are easier to finance, quicker to permit and simpler to deploy. They also are less expensive. With the collapse of module pricing last year, panel costs fell to between $3.50 and $5.50 a watt from $6 or more, says Ted Sullivan, senior analyst at Lux Research. Costs of solar thermal remain largely unchanged at $7 to $8 a watt.

Still SolarReserve isn’t deterred. “It’s more competitive now, no question,” concedes Georgis. But “our power plants are not intermittent resources (and) we’re offering competitive pricing.”

So will the new generation of plants be successful? “It’s too early to say,” says Sullivan. “There have been a lot of plans out there, but nothing has been built on that scale.”

With many technologies showing promise, it will be interesting to see who goes first.